In this article we shall discuss about Electronic Liability Register under GST in detail with help of important frequently asked questions (FAQs) and detailed manual on how to view it on the GST portal.

As per Section 49(7) of the CGST Act,2017 all liabilities of taxable person under this act shall be recorded and maintained in an “electronic liability register” in such manner as may be prescribed. As per rule 85 of the CGST Rules, 2017, the electronic liability register specified under 49(7) shall be maintained in FORM GST PMT-01 for each person liable to pay tax, interest, penalty, late fee or any other amount on the common portal and all amounts payable by him shall be debited for the said register. The electronic liability register is maintained in FORM GST PMT-01 for each person liable to pay tax, interest, penalty, late fee or any other amount on common portal.

The electronic liability register will be maintained in two parts at the common portal:-

- Part-I will be for maintaining the return related liabilities. All liabilities accruing due to return and payments made against the same will be recorded in this part of the register and payment made against the same will be recorded in this part of register

- Part-II will be for maintaining the complete description of transaction of all liabilities accruing, other than return related liabilities.

A. FAQs on Electronic Liability Register under GST

Q.1 What is an Electronic Liability Register?

Ans: All return related liabilities accrued are displayed in the Electronic Liability Register: Part I: Return related liabilities. Payments made from the Electronic Cash Ledger and/or credit utilized to discharge the liabilities are also shown in the register. Liabilities pertaining to GST CMP-03, GST ITC-03 and GST REG-16 are also posted in Part-I. It can be accessed in the post-login mode using the path Services > Ledgers > Electronic Liability Register > Part-I: Return related liabilities.

All liabilities other than return related are displayed in the Electronic Liability Register: Part II: other than return related liabilities. Payments made from the Electronic Cash Ledger and/or credit utilized to discharge the liabilities are also shown in the register. Liabilities not covered in Part-I are accounted for in Part-II. It can be accessed in the post-login mode using the path Services > Ledgers > Electronic Liability Register > Part – II: Other than return related liabilities.

Q.2 Who maintains the Tax Liability Register?

Ans: The Electronic Liability Register is maintained by the GST System. The electronic liability register is only for viewing by the User. No entry can be directly made in the electronic liability register.

Q.3 Where can the taxpayers view their Tax Liability Register?

Ans: The Electronic Liability Register can be accessed in the post-login mode using the path Services > Ledgers > Tax Liability Register.

Q.4 Can anyone else also view my Tax Liability Register?

Ans: The taxpayers, authorized GST Practitioner and his jurisdictional officer can view the Tax Liability Register.

Q.5 Can taxpayers view the liabilities related only to returns?

Ans: For the convenience of the taxpayers, Liability Register has been divided into two parts. The first part covers return related liabilities and the second part covers liabilities other than returns. The taxpayer can view both the parts of the register.

Q.6 How can taxpayers view liabilities in the Electronic Liability Register?

Ans: The landing page of the Electronic Liability Register has a summary of all return related and non-return related liabilities of the taxpayer. It can be accessed in the post-login mode using the path Services > Ledgers > Tax Liability Register

Q.7 Can I make payments in advance for future liabilities?

Ans: No, you cannot make payments for future liabilities.

Q.8 If the amount in dispute, is stayed by Appellate Authority or Court, also shown in the Tax Liability Register?

Ans: Yes, it is shown in the Electronic Liability Register Part – II: Other than return related liabilities in the liability part with a flag indicating ‘stayed’. Whenever, the appeal is decided, the status is updated and depending on the decision, the register gets updated.

Q.9 Will the recoveries made by the Departmental Officer also be displayed in the Tax Liability Register?

Ans: Yes, all payments made against a liability are shown in the Liability Register irrespective of whether the payment/s were made by taxpayers or by the Departmental Officer by initiating recovery proceedings.

Q.10 Can taxpayers claim refund of the deposits made for entertaining appeal or otherwise for stay, if the appeal is allowed?

Ans: Yes, Refund will be granted only when final order regarding the appeal is passed. The Electronic Liability Register gets updated accordingly.

Q.11 Will the liabilities due to reversal of credit due to non-acceptance of added invoices in inward supplies details by recipients at suppliers’ end also be posted in the Tax Liability Register?

Ans: Yes, all kinds of liabilities are shown in the Electronic Liability Register. The liabilities may be due to reversal of excess credit claimed or due to reduction in output tax claimed by supplier by issuing credit note.

Q.12 Can I as a taxpayer download the Electronic Liability Register?

Ans: Yes. You as a taxpayer can download and save the Electronic Liability Register in PDF and Excel format from your dashboard on your local machine.

Q.13 Who are the tax payers for whom Electronic Liability Register is not maintained?

Ans: Electronic Liability Register is not maintained for UIN holders.

Q.14 Is Electronic Liability Register maintained for casual taxpayers?

Ans: Electronic Liability Register is maintained for casual taxpayers as well.

Q.15 From where Other than return related liabilities are flowing in Electronic Liability Register?

Ans: Other than return related liability will be flowing mainly from Assessment/Adjudication orders, Appeal orders. Other orders where demand is created also flows in the register.

Q.16 From where return related liabilities are flowing in Electronic Liability Register?

Ans: Return related liability will be flowing from GSTR-3, 3B, 4, 5, 5A, 6, 7, 8, 9, 10, ITC-03, Application for surrender of registration etc.

Q.17 How voluntary payments made by taxpayer captured in Electronic Liability Register?

Ans: Whenever payments are made against SCN etc., simultaneously a debit as well as a credit entry are passed in the Liability ledger.

Q.18. Can a GST Practitioner view my Electronic Liability Register? Can I allow or deny access to my GST Practitioner to view my Electronic Liability Register?

Ans: Yes, a GST Practitioner can view your Electronic Liability Register who has been authorized by you. You can allow or deny to GST practitioner the facility to view your Liability Register through the utility of online engaging/ disengaging a GST practitioner.

Q.19 What are the instructions displayed on the Electronic Liability Register – Part II page?

Ans: The instruction displayed on the Electronic Liability Register – Part II page says following:

- The payment entries are updated from Utilize cash and/or ITC from Electronic Cash Ledger/Electronic Credit Ledger and also from actions of tax officer while processing and finalizing Refund.

- Any reduction or enhancement in the amount payable due to decision of appeal, rectification, revision, review etc. is reflected in Electronic Liability Register – Part II.

- Payment against a demand which gets reduced subsequently may lead to a situation wherein the liability register shows a negative balance for a particular Demand ID if appeal is allowed/partly allowed. Overall closing balance may still be positive.

- Refund of pre-deposit or negative balance can be claimed for a particular demand ID if appeal is allowed even though the overall balance may still be positive. This is however subject to the adjustment of the refund against any liability by the proper officer.

- The closing balance in this part shall not have any effect on filing of return.

- In order to make payment against amount mentioned in SCN or suo-moto before issue of SCN, taxpayer needs to file an application in Form DRC-03 making a declaration of amount which he wishes to pay. Both the debit as well as credit entries for deposits in this case are created in the liability register simultaneously.

- Reduction in amount of penalty would be automatic, based on payment made after show cause notice or within the time specified in the Act or the rules.

Q.20 What is the meaning of DR/CR/RD/RF as displayed in the Register?

Ans: The meaning of DR is debit or payable, CR is credit or paid, RD is reduction and RF is refund adjusted.

B. Manual on how to view Electronic Liability Register under GST

Manual on Electronic Liability Register

a. How can I view the Electronic Liability Register?

In an Electronic Liability Register, all liabilities accrued by the taxpayer are displayed. Payments made from the Electronic Cash Ledger and/or credit utilised to discharge the liabilities are also shown in the register.

To view the Electronic Liability Register, perform the following steps:

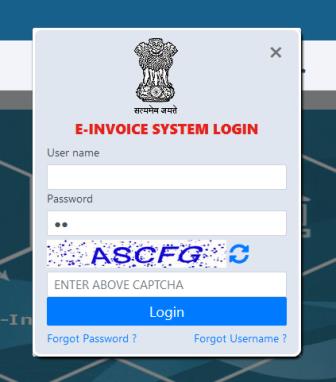

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services > Ledgers > Electronic Liability Register command.

The Liability Register page is displayed.

Part – 1 Return related liabilities

Part – II: Other than return related liabilities

Part – 1 Return related liabilities

4. Select the Part – 1 Return related liabilities link.

5. The Electronic Liability Register page is displayed. From the Financial Year and Month drop-down list, select the financial year and month for which you want to view the Electronic liability register.

6. Click the GO button.

The Liability register details are displayed.

Note: Click the SAVE AS PDF and SAVE AS EXCEL button to save the Electronic Liability register in the pdf and excel format.

You can click the link under Integrated Tax, Central Tax, State Tax and Cess to view further details.

Note: The Minor Heads include: Tax, Interest, Penalty, Fee, Others and Total. The Minor Head wise balance is displayed for the selected Major Head.

Part- II: Other than return related liabilities

4. Select the Part – II: Other than return related liabilities link.

5. The Electronic Liability Register page is displayed.

6. Select the search criteria from the choices available. You can select the Stay Status from the drop-down list.

7. Click the GO button.

The Liability register details are displayed.

Note: Click the SAVE AS PDF and SAVE AS EXCEL button to save the Electronic Liability Ledger in the pdf and excel format.

Use the scroll bar to view more details.

You can click the link under Amount debited/ credited and Balance to view further details.

Details will appear as below:

Source: GST portal

***

[rainbow]Don’t miss the next GST Update / Article / Judicial pronouncement[/rainbow]

Subscribe to our newsletter from FREE to stay updated on GST Law

Resolve your GST queries from national level experts on GST free of cost.

TW Editorial Team comprises of team of experienced Chartered Accountants and Advocates devoted to spread the knowledge of GST amongst the various stakeholders.