Talking to the Economic Times (ET), Bajaj, who superannuates on November 30, said: We have to rationalise rates under the Goods and Services Tax (GST),…reduce the number of slabs and relook at exemptions. Then there are some issues like online gaming, and the setting up of tribunals. Such issues will keep coming up, so they need to be resolved.

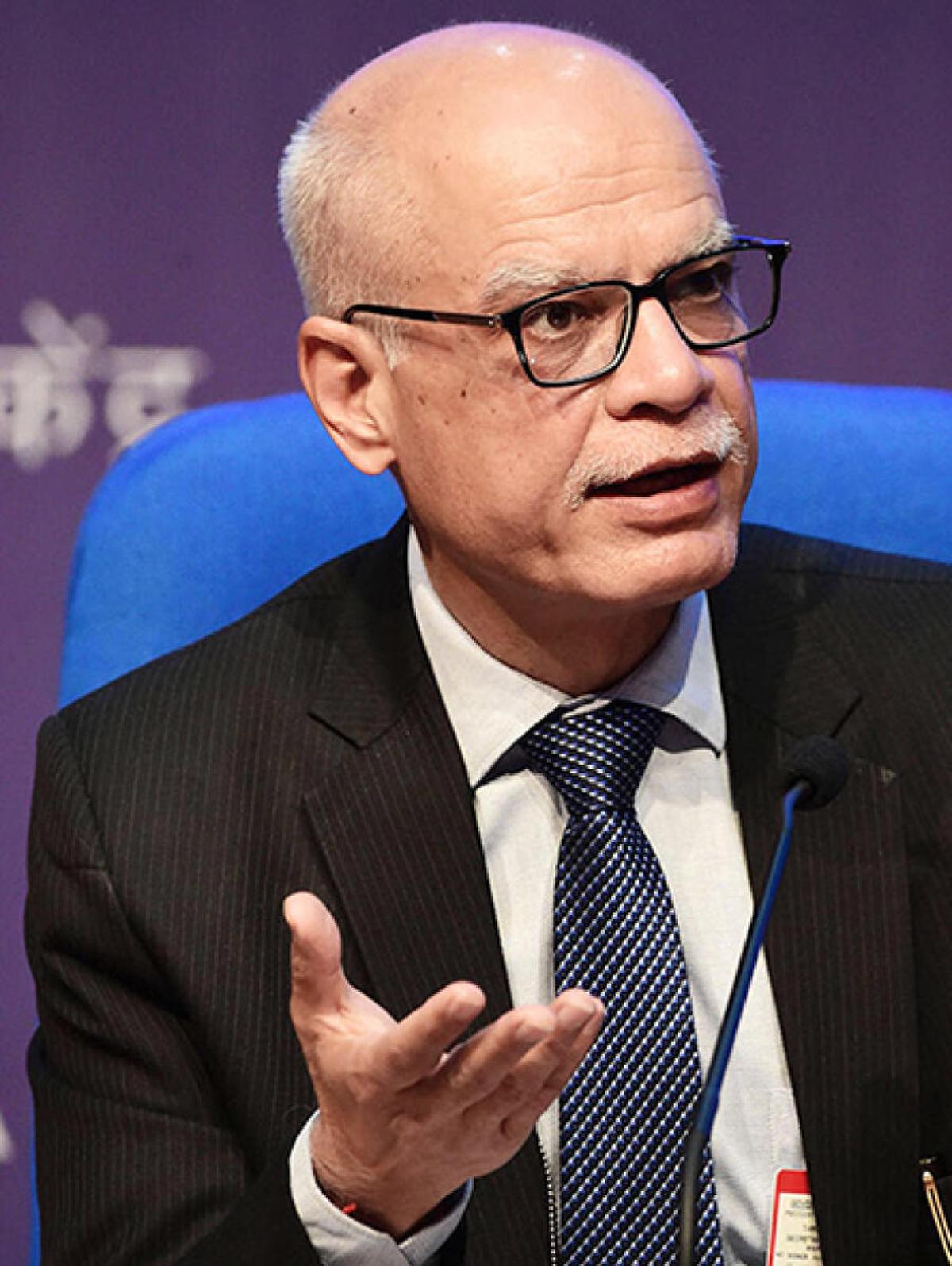

Pointing out some emerging issues in income tax (I-T) and Goods and Services Tax (GST), Revenue Secretary Tarun Bajaj said there is a need for reforms in both direct and indirect taxes.

Talking to the Economic Times (ET), Bajaj, who superannuates on November 30, said: “We have to rationalise rates under the Goods and Services Tax (GST),…reduce the number of slabs and relook at exemptions. Then there are some issues like online gaming, and the setting up of tribunals. Such issues will keep coming up, so they need to be resolved.”

Bajaj further said we should also look at getting gas and ATF (aviation turbine fuel) into GST.

“On the direct taxes side, (there are) about two, or three issues. One is to fix the capital gains on all fronts. Second is the personal income tax and the third is to rewrite the code to simplify it. If you do that, litigation will reduce,” said Bajaj.

Bajaj said we need to rewrite the personal tax regimes to make the new regime better than the old one.

“Under the new regime, the exemption limit is ₹2.5 lakh while in the old scheme you don’t have to pay any taxes up to ₹7.5 lakh. Most people fall within this income bracket and so they have no incentive to come to the new tax regime,” said Bajaj.

The Revenue Secretary said that the government is simplifying the tax structure but more reforms are needed.

“We are now trying to provide one income-tax return form in place of six. This itself is a way toward simplification. We have introduced a faceless system in direct tax and customs. We have brought in a lot of reforms but there are still a lot of things that need to be done,” said Bajaj.

Source: livemint.com

***

Don’t miss the next GST Update / Article / Judicial pronouncement

Subscribe to our newsletter from FREE to stay updated on GST Law

Resolve your GST queries from national level experts on GST free of cost.

TW Editorial Team comprises of team of experienced Chartered Accountants and Advocates devoted to spread the knowledge of GST amongst the various stakeholders.