Rule-60(7) of CGST Rules-2017 prescribes for generation of auto-drafted statement containing the details of input tax credit in FORM GSTR-2B for counter-party recipients. As per Rule-60(8) of CGST Rules-2017, FORM GSTR-2B shall be made available to the recipients after the Due date of filing GSTR-1/IFF by the suppliers.

In normal situations, the GSTR-2B is generated on 14th of next month. However as Notification No. 17/2021-CT and 27/2021-CT, both dated 1st June 2021 has extended the Due date of GSTR-1 and IFF for May 2021, to 26th and 28th June 2021, respectively. Consequently, GSTR-2B for May 2021 will be generated after these Due dates, on 29th June 2021.

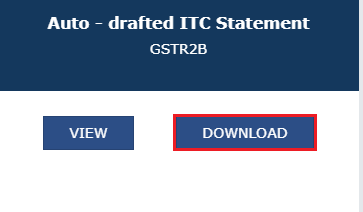

To view and download Form GSTR-2B on GST Portal, perform following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal with valid credentials. Click the Services > Returns > Returns Dashboard option.

Note: Alternatively, you can also click Return Dashboard.

2. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to view Form GSTR-2B from the drop-down list. Click the SEARCH button. Form GSTR-2B tile is displayed.

3.1. If number of documents across all tables of Form GSTR-2B is more than 1000, then you can either use the advance search option of download the document details in excel/JSON format from the download page of Form GSTR-2B. Click the DOWNLOAD button to navigate to download page of Form GSTR-2B.

3.2. Click the GENERATE JSON FILE TO DOWNLOAD button to generate data in the JSON format to view in Offline Matching Tool or click the GENERATE EXCEL FILE TO DOWNLOAD button to generate data in the excel format.

4. View GSTR-2B

4.1. In the Form GSTR-2B tile, click the VIEW button.

Note: If number of documents across all tables of Form GSTR-2B is less than 1000, then you can view the document details directly on GST Portal.

4.2. The Form GSTR-2B – AUTO DRAFTED ITC STATEMENT page is displayed. Form GSTR-2B has two tabs as SUMMARY and ALL TABLES.

SUMMARY TAB

4.3. The Summary tab is divided into 2 parts:

- Part A (ITC Available): A summary of ITC available as on the date of its generation and is divided into credit that can be availed and credit that is to be reversed (Table 3)

- Part B (ITC not Available): A summary of ITC not available and is divided into ITC not available and ITC reversal (Table 4)

Note:

- You can click the DOWNLOAD GSTR-2B SUMMARY (PDF) or DOWNLOAD GSTR-2B SUMMARY (EXCEL) button to view the Form GSTR-2B details in PDF or Excel format. The downloaded excel will contain the summary of Form GSTR-2B and all the table and document details. If the total number of documents across all tables is more than 1000, then DOWNLOAD GSTR-2B SUMMARY (EXCEL) button will be disabled. However, you may download the excel from Form GSTR-2B download page (refer step 3), by using the link given in information message below the summary table.

- You can click the Expand All to expand/collapse all the sections available in Form GSTR-2B summary. By default, all the sections in Form GSTR-2B summary is in collapse mode.

- Click the Help button to view the details related to this particular screen.

- Click the View Advisory link to view and download the advisory. You can view the cut-off dates considered for Form GSTR-2B from the pop-up page. You can click the DOWNLOAD ADVISORY button to download Form GSTR-2B advisory in PDF format.

4.4. On click of the hyperlinks provided in the headings column of Form GSTR-2B summary, you can navigate in details in the GSTR-2B table and view pre-filtered document details.

4.5. Click B2B Invoices hyperlink available under Part A Section I of ITC Available summary to navigate to Taxable inward supplies received from registered person – B2B table.

4.6. You will be navigated to Documents Details under ALL TABLES tab for that particular section. You can view pre-filtered document details of inward supplies received from registered persons which is Other than reverse charge and ITC availability is yes.

Note: On click of amendment hyperlinks available in GSTR-2B summary, you will be navigated to the Document Details under ALL TABLES tab for the respective amendment table. You can view document details of all the amended documents.

4.7. If you have more than 1000 documents across all tables of Form GSTR-2B, document details table will not be displayed online. You can download GSTR-2B statement through excel/JSON by clicking on Download link as available in the information message (refer to step no.3).

Note:

- Click Download Excel to download the details in an excel format.

- Display/Hide Columns – Using this option, you can select columns to hide or show.

- Records Per Page – This is an option available to fix the pagination. Taxpayer can use this option to view number of records per page.

- Apply Filter – You can use the filter option and view auto-drafted documents as per the applied filter.

- Search – This is a general search functionality which is applicable across all columns for the table being viewed. By using this functionality, you can search required details.

- Sorting – Using this option

, you can sort the column details.

, you can sort the column details.

Note: If the number of records across all tables of Form GSTR-2B is more than 1000 documents, then advance search option will be enabled. By using this option, taxpayers can view a particular document. You can use Advance search option to search for any document online as shown below.

4.8. Click the Invoice number hyperlink to view the details of tax. The Tax details are displayed.

4.9. Click Back to Summary button to go back to summary page.

Note: Similarly, you can view details for other tables.

ALL TABLES TAB

4.10. Click ALL TABLES tab to select an appropriate table from the drop-down list to view details.

- B2B Table of GSTR-2B: Taxpayer can view auto-drafted inward supplies received from registered persons (including inward supplies attracting reverse charge) in this table.

- B2BA Table of GSTR-2B: Taxpayer can view auto-drafted details of amendment to inward supplies received from registered persons (including inward supplies attracting reverse charge) in this table.

- B2B CDNR Table of GSTR-2B: Taxpayer can view auto-drafted debit or credit notes received from registered persons in this table.

- B2B CDNRA Table of GSTR-2B: Taxpayer can view auto-drafted of amendment debit or credit notes received from registered persons in this table.

- ISD Table of GSTR-2B: Taxpayer can view auto-drafted details of input tax credit received from input service distributors/ ISD.

- ISDA Table of GSTR 2B: Taxpayer can view auto-drafted details of amendment to input tax credit received from input service distributors/ ISDA.

- IMPG Table of GSTR 2B: Taxpayer can view auto-drafted details of import of goods from overseas on bill of entry.

- IMPGSEZ Table of GSTR 2B: Taxpayer can view auto-drafted details of inward supply received from SEZ units / developers on bill of entry.

4.11. On selecting a table, you can view the documents details of that table.

4.12. You can select Supplier wise Details tab, to view supplier wise details of the documents available in the said table.

4.13. On Click of GSTIN hyperlink, you can navigate to Document details tab and view documents received only from the said supplier.

Note:

- Similarly, you can view details for other tables.

- For Import of goods from overseas on bill of entry – IMPG table, only document details are available and no supplier wise details are available.

Also Read: All about auto population of details in Form GSTR-3B from Form GSTR 1 & GSTR 2B

Source: GST Portal

Follow us for free tax updates : facebook Twitter

Subscribe our portal and get FREE Tax e-books , quality articles and updates on your e-mail.

Resolve your GST queries from national level experts on GST free of cost.

Frah Saeed is a law graduate specializing in the core field of indirect taxes and is the Co-founder of taxwallah.com. She has authored many publications on GST and is into full-time consultancy on GST to big corporates. She as a part of taxwallah.com heads a team comprising of Chartered Accountants and Advocates and plays a key role in our mission to disseminate GST knowledge to all.