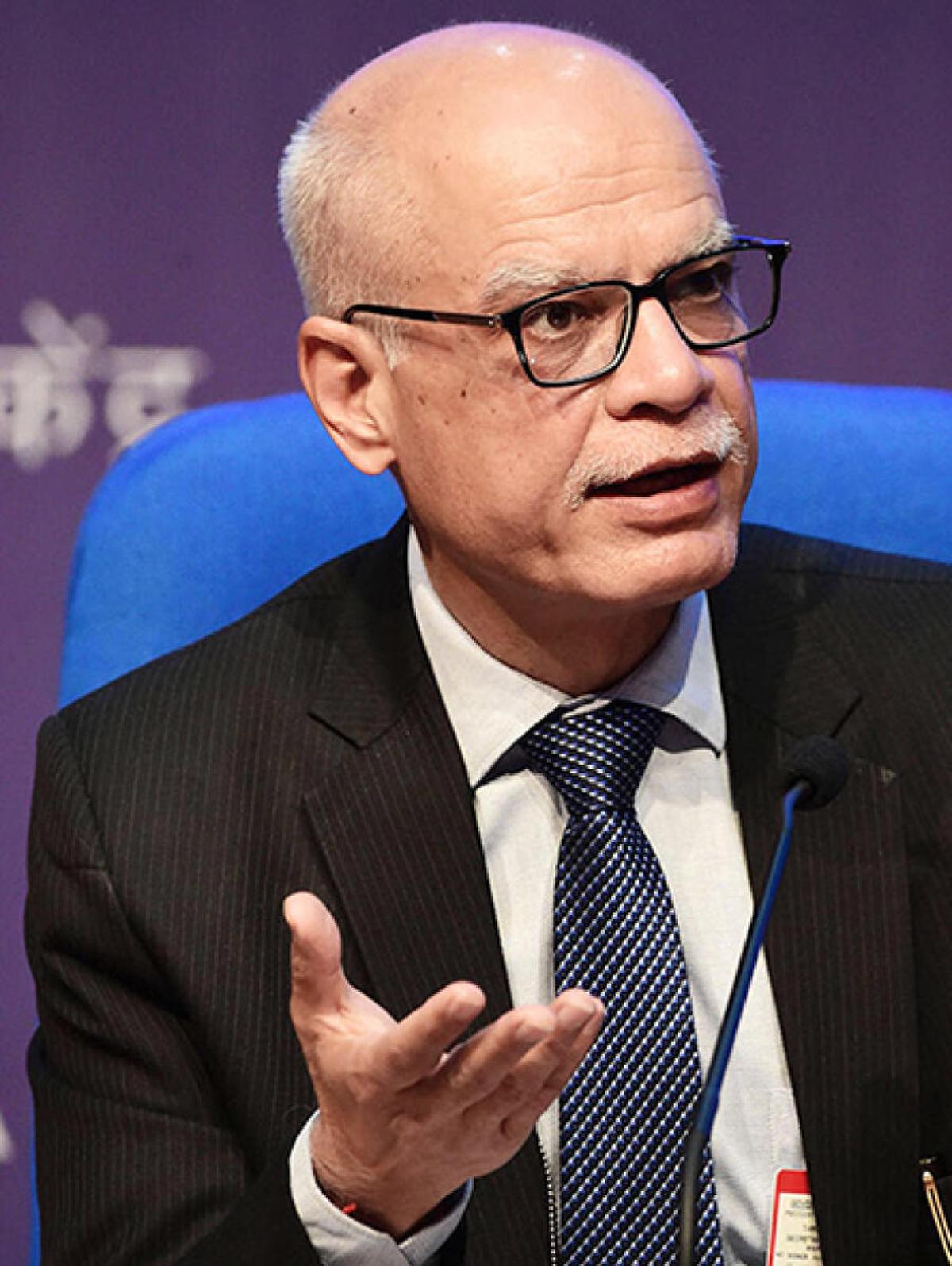

Revenue Secretary Tarun Bajaj has said the government will soon come out with norms for decriminalising offences under Goods & Services Tax (GST).

In an interview to businessline, he also said that windfall gain tax on domestically produced crude oil and on export of diesel and ATF will continue till there is windfall gain. Excerpts:

The government recently comes out with revised guidelines for compounding offences under Direct Taxes. Earlier, a similar arrangement was made in case of customs duty-related offences. Now, what is the plan for decriminalisation of offences under GST?

We are working on it and soon we will release (the document). We would move in the same direction as we moved on the custom side and direct taxes side. We are not interested in people into jail.What we want is that if we can compound, if there has been a mistake on the part of a corporation or a person, let them pay the money with penalty and move on or compound the offence and move on.This is very essential and now we are increasing our compliance and once you do that people also realise they can’t getaway. They want to come out clean. This is another way of people coming out clean.

What is the preparation for Global Minimum Corporate Tax? Are we on track?

I think we are on track. The first thing would be to amend the legislation which we will do once we have the clearer picture about when it is going to be implemented.In terms of competence, we are actually part of the OECD team that is working very closely on rules, guidelines, and how this will actually be calculated between the country in which the company exists and the country where it is selling its products.We feel very comfortable and in fact, we have also mentioned to the global community that we are ready to help out the developing nation, improving their competence to implement new mechanism.

There is discussion about that new regime would give lesser revenue to the government. What do you have to say?

We have done a very rough estimate. We feel that to start with, we might be neutral but over a period of time, we will gain because now the market economy is the norm.Our middle class is growing. Our incomes are rising. We will consume more products of these companies and in that sense, our tax growth rate will be much higher. So, to start with, we might be breaking even but over a period of time we will keep getting more money through this process

There is a demand for doing away with windfall gain tax. What is the thinking in the Finance Ministry?

There are two taxes; one is on domestically produced crude and the other is on diesel and ATF. As far as domestic crude is concerned, we have levied a windfall tax because crude prices were very high. I understand prices have come down during the last two weeks and accordingly we brought down the taxes.Now, we will see if prices come even from this level, maybe the need for windfall tax will automatically go away and then there will be no demand then required for doing away with the tax. Talking about the products, till the time, the products are giving abnormal profit to these companies, we have levied these taxes and they should continue till that time. But may I say that even while we have levied the windfall gain taxes, we have left a lot on the table. So all the windfall gain has not been wiped away from these companies, some of it has been given to them. Also, they have the benefit of Indian currency depreciating viz-a-viz USD, which we have not even accounted for in our calculations. So that benefit automatically goes to them.

Is there any level of crude prices the Ministry has in mind to do away with the windfall gain tax?

On average, the prices are still in the mid-90s. It needs to come down a little more. We do a calculation where we do some averaging and it takes some effort. It would not be proper on my part to talk about levels of 90, 85 or 80, but one thing I would like to say here is that we are changing the tax every two weeks and reducing it. This also should give the confidence to both the corporate and to the people. We are actually taking into account international prices and windfall tax is again on windfall gain. So, till the time windfall gain remains, we will continue with windfall tax.

Source: thehindubusinessline.com

*****

Don’t miss the next Tax Update / Article / Judicial pronouncement

Subscribe to our newsletter for FREE to stay updated on GST Law

Resolve your GST queries from national level experts on GST free of cost

TW Editorial Team comprises of team of experienced Chartered Accountants and Advocates devoted to spread the knowledge of GST amongst the various stakeholders.